How much tax do you pay on bitcoin australia images are available in this site. How much tax do you pay on bitcoin australia are a topic that is being searched for and liked by netizens today. You can Find and Download the How much tax do you pay on bitcoin australia files here. Get all royalty-free photos and vectors.

If you’re looking for how much tax do you pay on bitcoin australia pictures information linked to the how much tax do you pay on bitcoin australia interest, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. Income tax is charged on the fair market value of the received coins ex. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax.

How Much Tax Do You Pay On Bitcoin Australia. This information is our current view of the income tax implications of common transactions involving cryptocurrency. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange.

Pin On Help With Bitcoins From in.pinterest.com

Pin On Help With Bitcoins From in.pinterest.com

The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. This information is our current view of the income tax implications of common transactions involving cryptocurrency. Income tax is charged on the fair market value of the received coins ex. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax.

If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300.

The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. This information is our current view of the income tax implications of common transactions involving cryptocurrency. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. Income tax is charged on the fair market value of the received coins ex.

Source: pinterest.com

Source: pinterest.com

The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. Income tax is charged on the fair market value of the received coins ex. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. This information is our current view of the income tax implications of common transactions involving cryptocurrency.

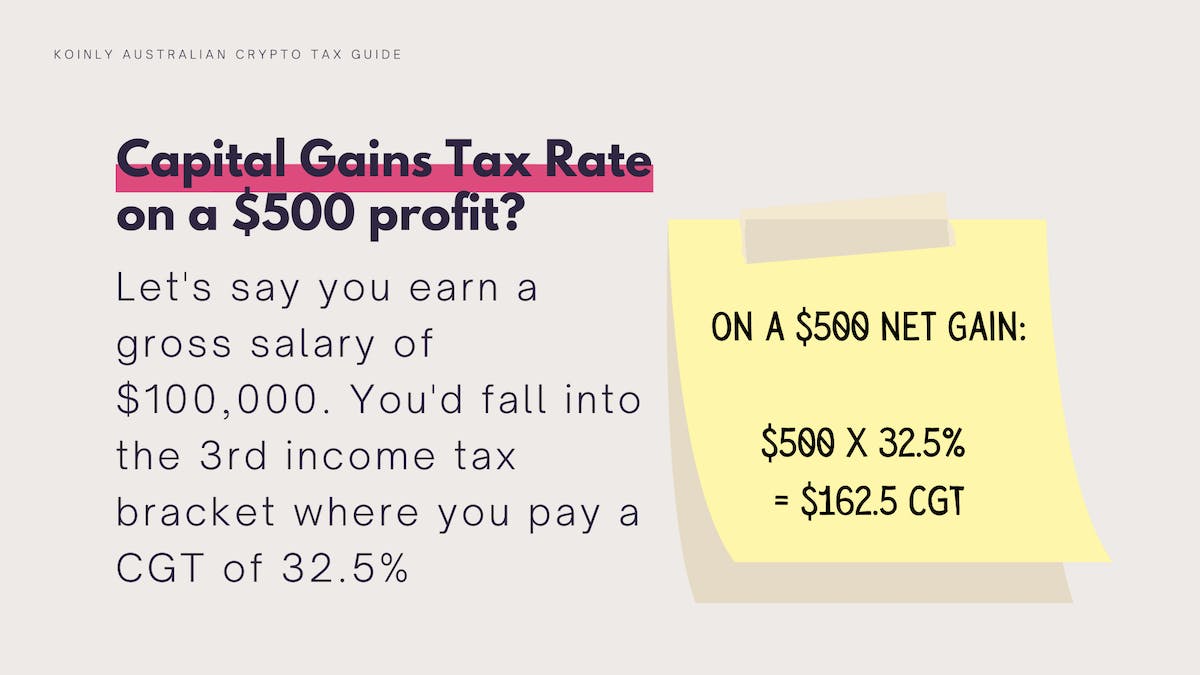

Source: koinly.io

Source: koinly.io

This information is our current view of the income tax implications of common transactions involving cryptocurrency. Income tax is charged on the fair market value of the received coins ex. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. This information is our current view of the income tax implications of common transactions involving cryptocurrency. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300.

Source: pinterest.com

Source: pinterest.com

The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. This information is our current view of the income tax implications of common transactions involving cryptocurrency. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300.

Source: fullstack.com.au

Source: fullstack.com.au

Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. This information is our current view of the income tax implications of common transactions involving cryptocurrency. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. Income tax is charged on the fair market value of the received coins ex.

Source: pinterest.com

Source: pinterest.com

If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. Income tax is charged on the fair market value of the received coins ex. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax.

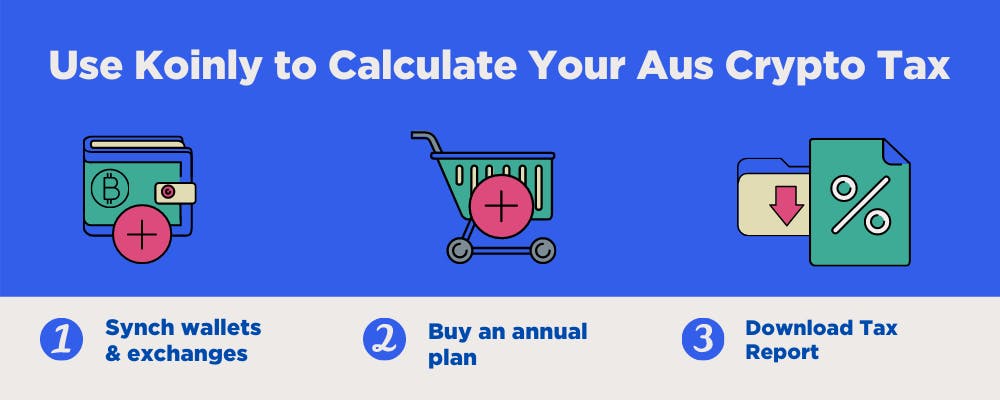

Source: koinly.io

Source: koinly.io

Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. Income tax is charged on the fair market value of the received coins ex.

Source: ro.pinterest.com

Source: ro.pinterest.com

If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. Income tax is charged on the fair market value of the received coins ex. This information is our current view of the income tax implications of common transactions involving cryptocurrency. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes.

Source: pinterest.com

Source: pinterest.com

Income tax is charged on the fair market value of the received coins ex. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. Income tax is charged on the fair market value of the received coins ex. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300.

Source: pinterest.com

Source: pinterest.com

If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. Income tax is charged on the fair market value of the received coins ex. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300. This information is our current view of the income tax implications of common transactions involving cryptocurrency.

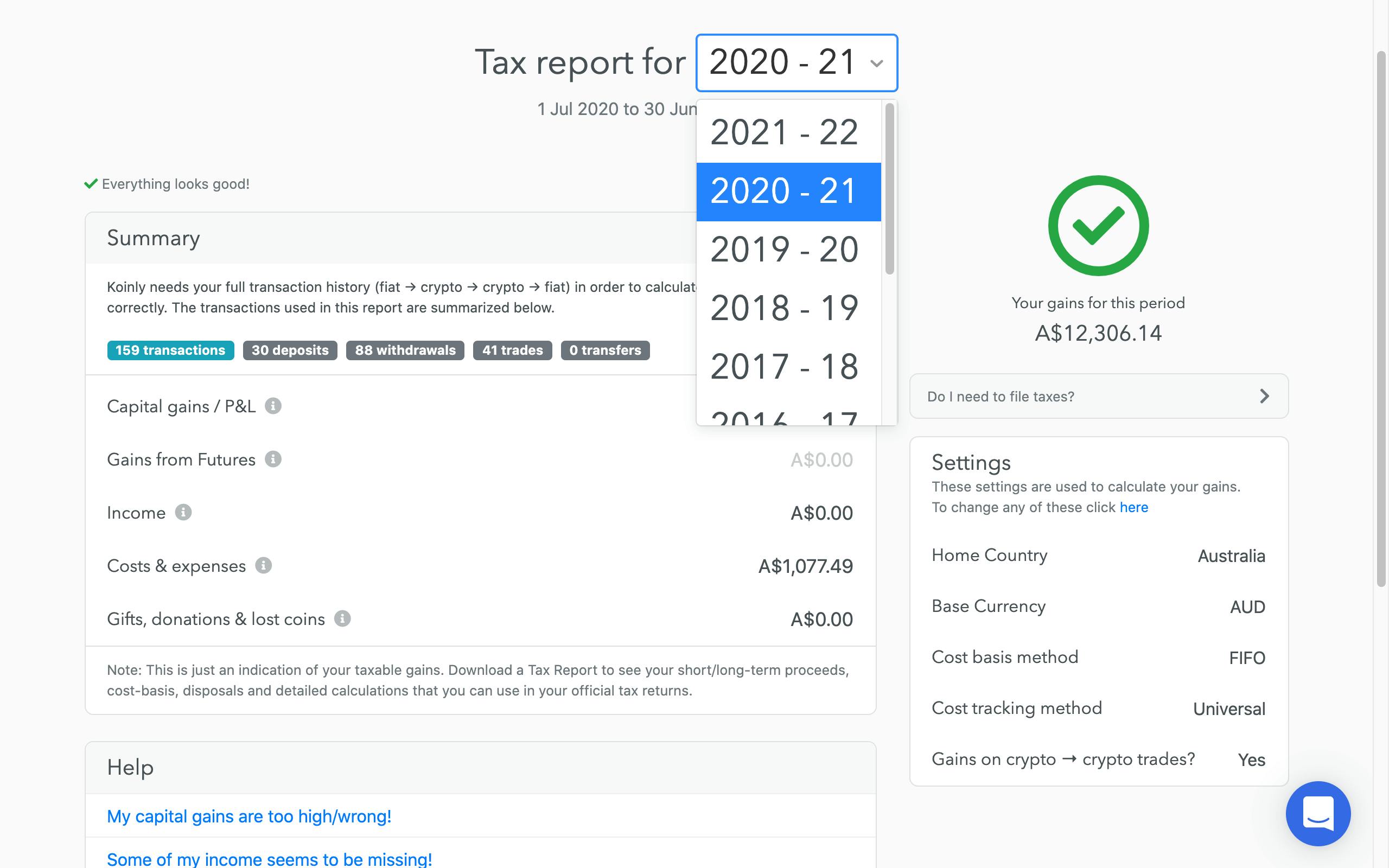

Source: koinly.io

Source: koinly.io

Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If your employer paid you a bonus of 005 BTC worth 300 then you will have to pay income tax on the whole 300.

Source: pinterest.com

Source: pinterest.com

Income tax is charged on the fair market value of the received coins ex. Any time you purchase business items including trading stock using bitcoin you are entitled to a tax. Any reference to cryptocurrency in this guidance refers to Bitcoin or other crypto or digital currencies that have similar characteristics as Bitcoin. The value in Australian dollars will be the fair market value at which they can be obtained from a reputable bitcoin exchange. If you receive bitcoin for goods or services provided as part of a business you will need to record the value of the bitcoins in Australian dollars as part of your ordinary income for tax purposes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much tax do you pay on bitcoin australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.